529 plans are specifically designed to help families - regardless of income level - save for college by offering the potential for tax-free growth and withdrawals if used for To encourage families to save for college.

#529 DISTRIBUTIONS RULES CODE#

The Internal Revenue Code of 1986, as amended. Section 529 of the Internal Revenue Code specifies the requirements for qualified tuition programs (529 Plans). State-sponsored 529 plans are tax-advantaged college savings plans authorized by

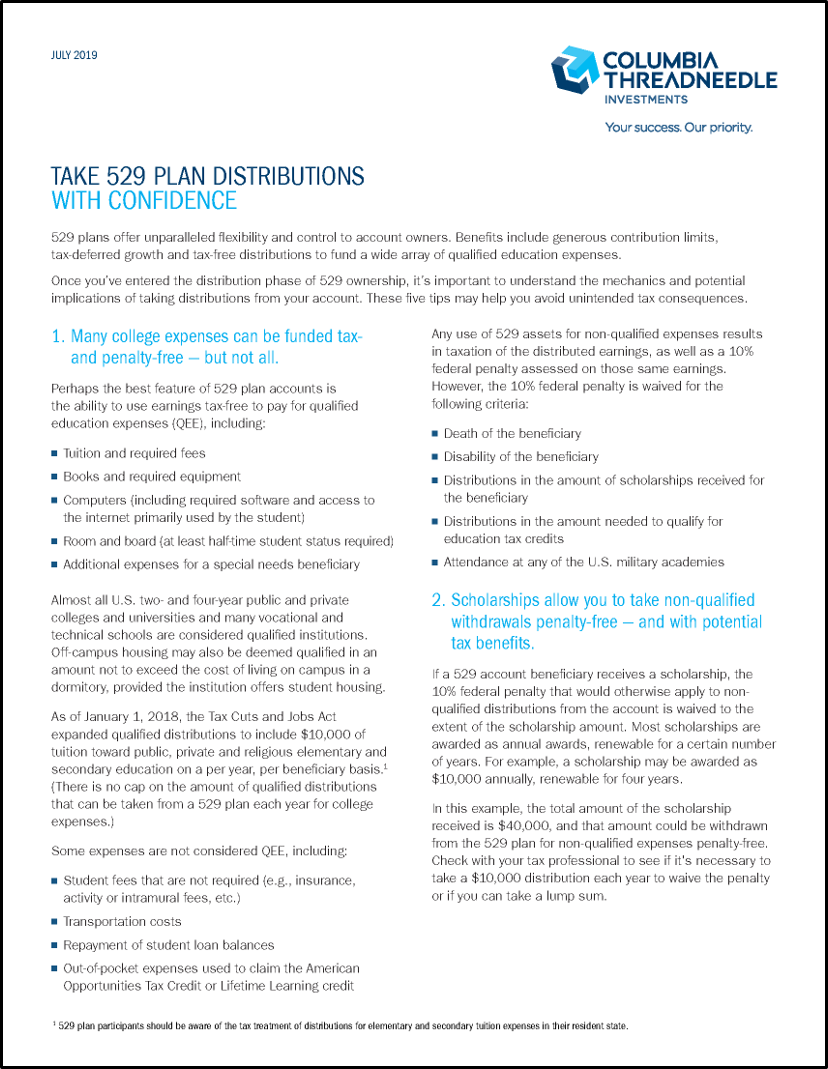

(Unqualified withdrawals may be taxable as ordinary income and subject to a 10% federal tax penalty.) The Pension Protection Act of 2006 made the tax-free character of 529s a permanent part of federal law. Earnings on 529 plans are tax-free if used for qualified higher education expenses.

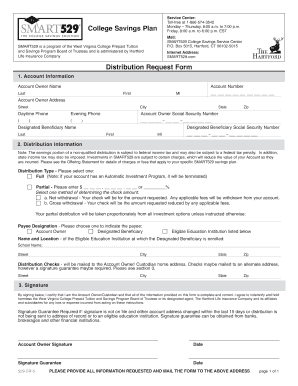

It is named after Section 529 of the internal revenue code, which authorized these types of tax-advantaged savings plans in 1996. Additional Informationįor additional information, refer to Publication 970, Tax Benefits for Education.A 529 plan is an education savings plan operated by a state or an educational institution and designed to help families set aside funds for college. Form 1099-Q should be made available to you by January 31, 2023. The amount of your gross distribution (box 1) shown on each form will be divided between your earnings (box 2) and your basis or return of investment (box 3). You should receive a Form 1099-Q, Payments from Qualified Education Programs (Under Sections 529 and 530) from each of the programs from which you received a QTP distribution. Interest paid with these funds doesn't qualify for the student loan interest deduction. The amount of distributions for loan repayments of any individual is limited to $10,000 lifetime. Amounts can be withdrawn to pay principal or interest on a designated beneficiary's or their sibling's student loan.

However, if the amount of a distribution is greater than the beneficiary's qualified higher education expenses (including tuition at an elementary or secondary public, private, or religious school), a portion of the earnings is taxable. Distributions aren't taxable when used to pay for qualified higher education expenses (including tuition at an elementary or secondary public, private, or religious school).The beneficiary doesn't generally have to include the earnings from a QTP as income.

#529 DISTRIBUTIONS RULES FREE#

Eligible educational institutions can also establish and maintain QTPs but only to allow prepaying a beneficiary's qualified higher education expenses. A qualified tuition program (QTP), also referred to as a section 529 plan, is a program established and maintained by a state, or an agency or instrumentality of a state, that allows a contributor either to prepay a beneficiary's qualified higher education expenses at an eligible educational institution or to contribute to an account for paying those expenses.

0 kommentar(er)

0 kommentar(er)